About Snowball Payoff Plan

Snowball payoff plan is a debt payment method taught and endorsed by many financial professionals. To explain the snowball payoff method, let’s use a real life scenario to illustrate how the method works.

Sarah is single woman in her early twenties working as a marketing executive. She has accumulated $2,600 in credit card debt, has an automobile loan with $15,200 balance and is still paying her student loan which has a balance of $580.

The first step of the snowball payoff method is to collect the essential information about all the debts. The following are the details on Sarah’s three debts:

- Credit Card - $2,600 balance; $360 monthly minimum payment; 24% interest rate

- Automobile Loan - $15,200 balance; $580 monthly minimum payment; 6% interest rate

- Student Loan - $580 balance; $300 monthly minimum payment; 3% interest rate

Sarah next selects the payoff order of the debts. Sarah plans to eliminate her debts by the “Lowest Balance” payoff order, which means she plans to payoff Student Loan ($580) first which has the lowest balance, then Credit Card ($2,600) and lastly the Automobile Loan ($15,200).

For the snowball method to work, Sarah will make the minimum monthly payment towards the three debts. To fast track debt payments, Sarah will make an Extra Payment of $200. This Extra Payment will be added to the minimum payment towards the payment of the first debt of the payoff order which is the Student Loan. The following are Sarah’s Month 1 debt payment under the snowball method:

- Student Loan - $500 ($300 minimum + $200 Extra Payment)

- Credit Card - $360

- Automobile Loan - $580

Sarah will be able to eliminate Student Loan on Month 2. Once a debt is paid off, the minimum payment of the debt together with the Extra Payment will then be snowballed towards the payment of the rest of the debts. The following are Sarah’s Month 3 debt payment under the snowball method:

- Credit Card - $860 ($360 minimum + $500 Extra Payment (snowballed amount))

- Automobile Loan - $580

Snowball payoff plan is a simple and realistic method. The key is the momentum. By focusing your effort on one debt at a time, you will see your debt eliminated and this encourages determination to stick to the plan.

Payoff Order

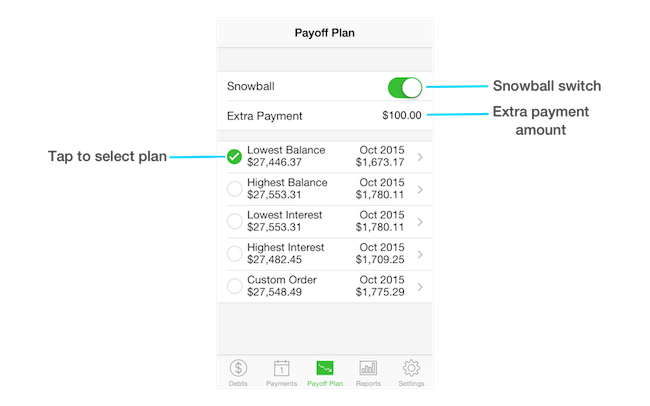

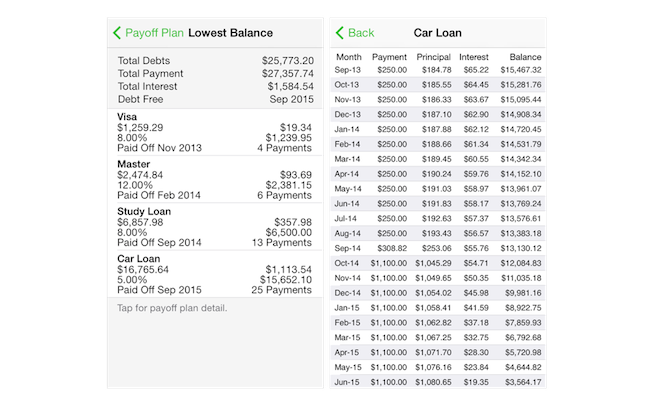

Debts app provides four preset payoff order under the Payoff Plan tab: Lowest Balance, Highest Balance, Lowest Interest and Highest Interest. You can also choose to use the Custom Order to have your preferred debts payoff order.

For each payoff order, Debts app calculates the debt free date, total payment and total interest incurred under the plan. You can also find out the detail monthly payment schedule of each debt under the plan.

Normally you will get the lowest total interest amount incurred under Highest Interest payoff order. i.e. eliminate debt with the highest interest rate first. But it does not mean that this is the right payoff order to use. It might take longer for the first debt to be eliminated under the Highest Interest payoff order. If the difference between interest payment is not great, you will be better off with Lowest Balance payoff order. The Lowest Balance payoff order gives you the psychological effect of seeing your debt eliminated quicker, thus gives you motivation to follow through your debt payment plan.